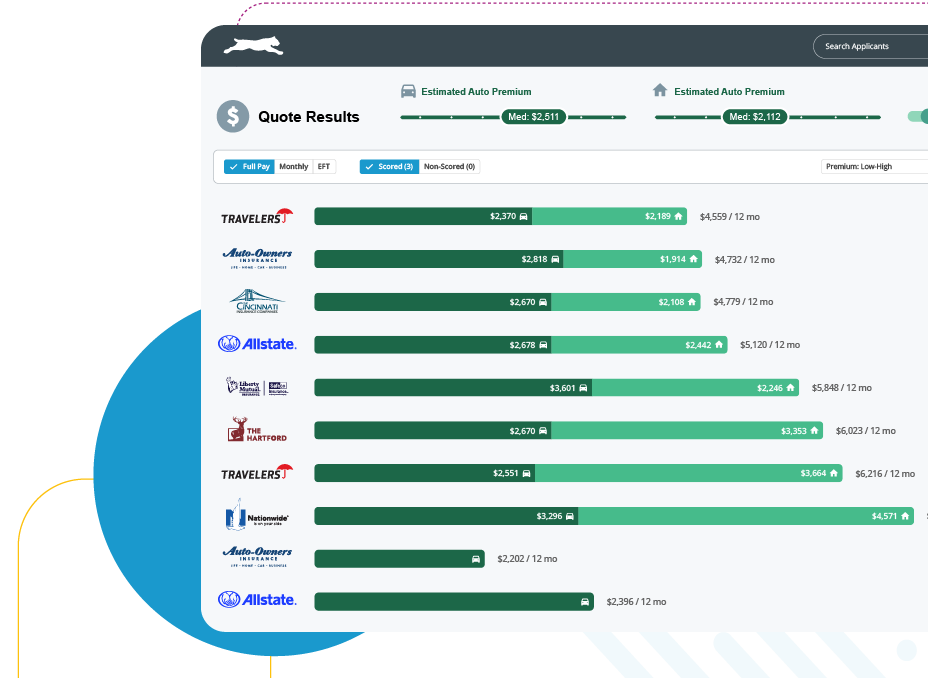

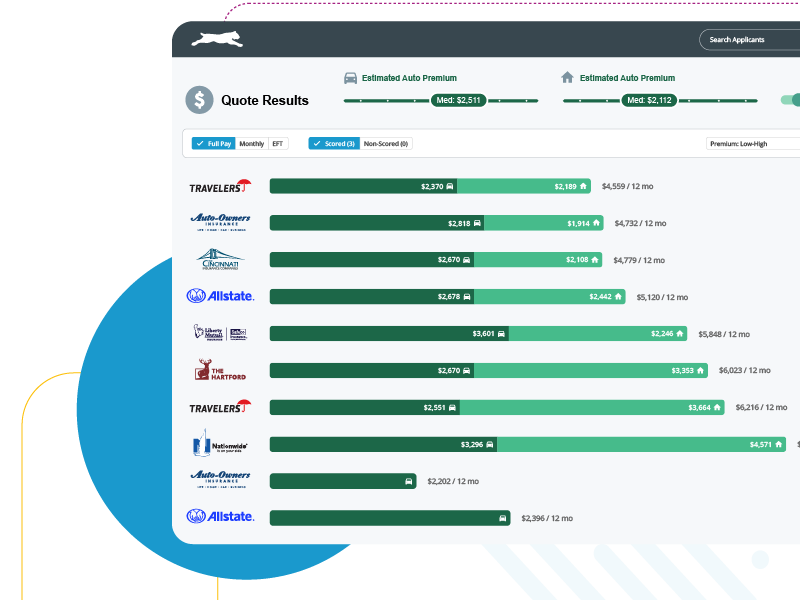

Get real-time quotes from 330 insurance carriers in seconds

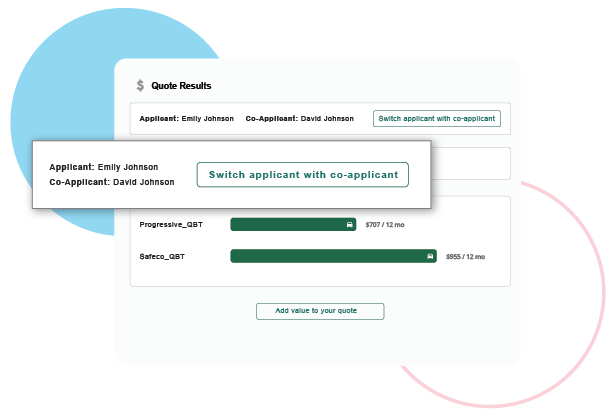

Home and Auto insurance shoppers expect competitive quotes from multiple carriers, but rekeying data into each individual carrier portal costs independent insurance agents precious time they can’t afford to lose. EZLynx Rating Engine™ is an easy-to-use comparative personal lines rater that lets you quote anytime, anywhere, on any device – even your phone. How it works is simple. Just enter the risk details once, and EZLynx Rating Engine instantly returns real-time quotes from multiple carriers. From there, you can go to a carrier’s portal to bind and issue a policy in a matter of minutes. EZLynx Rating Engine integrates with ours and over 20 other agency management systems to keep you from manually transferring data between software. With all your data unified in one place, EZLynx makes short work of remarketing, rounding out accounts, and pursuing business you didn’t win the first time around.

EZLynx has been leading the personal lines quoting crusade from the start

Twenty years ago, we set out to help agents quickly quote personal lines policies. Fast forward to today, and our comparative rater does way more than just provide quote information.

- Single data entry for multi-carrier submissions

- Producers can rate, bind, issue policies from carrier websites, and store ACORD forms

- Pre-fill capabilities fill in important customer details like driver, vehicle, building data and more

EZLynx Rating Engine is rated #1 for a reason

-

330+

Industry-leading carriers across 48 U.S. states

-

20K+

Agency users

-

8M

Home, auto, and package rating transactions every month

Why use a comparative rater?

Bind Business Quicker

Instant access to an extensive carrier list lets you quickly find the best products and beat your competition to the punch.

Boost Productivity

Quote templates with common answers, underwriting information, and producer codes can be stored, reducing manual entry and errors.

Increase Speed and Accuracy

Pre-fill and verified lookup features pull data from LexisNexis®, Fenris, MSB and Google Maps to save time and ensure accurate information.

Streamline Renewals

Customers can securely update their risk information online before re-quoting to streamline the renewal process.

Carrier Rating Guide

Search lines of business and consumer quoting availability by carrier and state.

Insurance agents like you use and love EZLynx

Comparative rater FAQs

A comparative rater is a SEMCI, or single-entry multiple-company interface. That means it’s software that takes information (in this case, customer data) and sends it to insurance companies (insurers and vendors) to generate information (quotes) from multiple sources, all without requiring re-entry of the original information. After a rater delivers insurance quotes from a wide range of carriers, an agency’s clients can compare those quotes to see which coverage option best meets their needs.

Definitely. Comparative rating systems help agents work faster by providing a platform where they only have to key in client information once to get quotes from multiple carriers nationwide. For instance, when agents input customer information, EZLynx Rating Engine gives them access to quotes from hundreds of insurance carriers in 48 states. EZLynx also offers pre-fill and lookup features, saving agents additional time by eliminating the need for data re-entry.

EZLynx Rating Engine offers direct access to the most extensive carrier library for real-time quote generation, so independent insurance agents can be sure that they’re as up to date and accurate as the initial customer information submitted into the system (no "manufactured" rates here). To ensure that the submitted client info is correct, EZLynx uses specially designed workflows to bring agents more precise results, automatically searching for and identifying incorrect or incomplete inputs and letting agents know about these inconsistencies before the data is submitted. Quote templates for carrier defaults or specific coverage scenarios also help ensure that agents are inputting and receiving the most consistent results possible.

Yes. EZLynx Rating Engine offers access to the most complete inventory of carriers, with 330 carriers across 48 states. The intuitive EZLynx rating workflow is filled with time-saving features so that agents can get more quotes completed in less time, and the 100% cloud-based PL rating software gives agents a sleek mobile-optimized interface that they can access anytime, anywhere and on any device.

Resources

-

Purchasing the Right Rating Software for Your Agency

Purchasing the Right Rating Software for Your AgencyFind out what a comparative rater is, the history of rating technology, and what a good rater should do for your insurance agency.

Read Now

-

The Power of an Insurance Comparative Rater

The Power of an Insurance Comparative RaterHear the benefits of having a rating engine, plus tips on choosing the right one and getting started using it.

Watch Now

-

10 Must-Haves for Your Insurance Rating Software

10 Must-Haves for Your Insurance Rating SoftwareLearn how comparative raters can help your agency save time, increase quote volumes, and improve your value proposition.

Read Now

Resources

-

Purchasing the Right Rating Software for Your Agency

Purchasing the Right Rating Software for Your AgencyFind out what a comparative rater is, the history of rating technology, and what a good rater should do for your insurance agency.

Read Now

-

The Power of an Insurance Comparative Rater

The Power of an Insurance Comparative RaterHear the benefits of having a rating engine, plus tips on choosing the right one and getting started using it.

Watch Now

-

10 Must-Haves for Your Insurance Rating Software

10 Must-Haves for Your Insurance Rating SoftwareLearn how comparative raters can help your agency save time, increase quote volumes, and improve your value proposition.

Read Now